The Current European Parliament Outlook

Throughout the 2019-2024 Parliament period, the development of sustainability reporting rules has been full steam ahead - particularly in the EU where the Corporate Sustainability Reporting Directive (CSRD) continues to represent the high-water mark of sustainability reporting in terms of scope and ambition. Until now, reporting has been a Wild West of differing standards, allowing companies to effectively cherry-pick what to report, how to report it, and what to quietly ignore. 2025 marks the calendar for large EU-based firms to report on ESG standards the way the EU dictates, following double materiality, where companies mugging up new sets of acronyms will be trending!

The following must be taken with a pinch of salt, according to the rise of the far right, particularly amid the German election tilting towards the centre-right (CDU/CSU) with 29%, followed by the far-right (AfD) with 21%, placing before centre-left (SPD) with only 16%. This occurrence is the first of its kind since the foundation of the Bundestag in 1949, suffering their worst ever defeat (The Economist, 2025). Seven EU Member States - Croatia, the Czech Republic, Finland, Hungary, Italy, the Netherlands, and Slovakia - currently have far-right parties within government, alongside Marie Le-Pen’s National Rally, winning by a clear margin across the opening round, however; finishing in third (International Bar Assosciation, 2024).

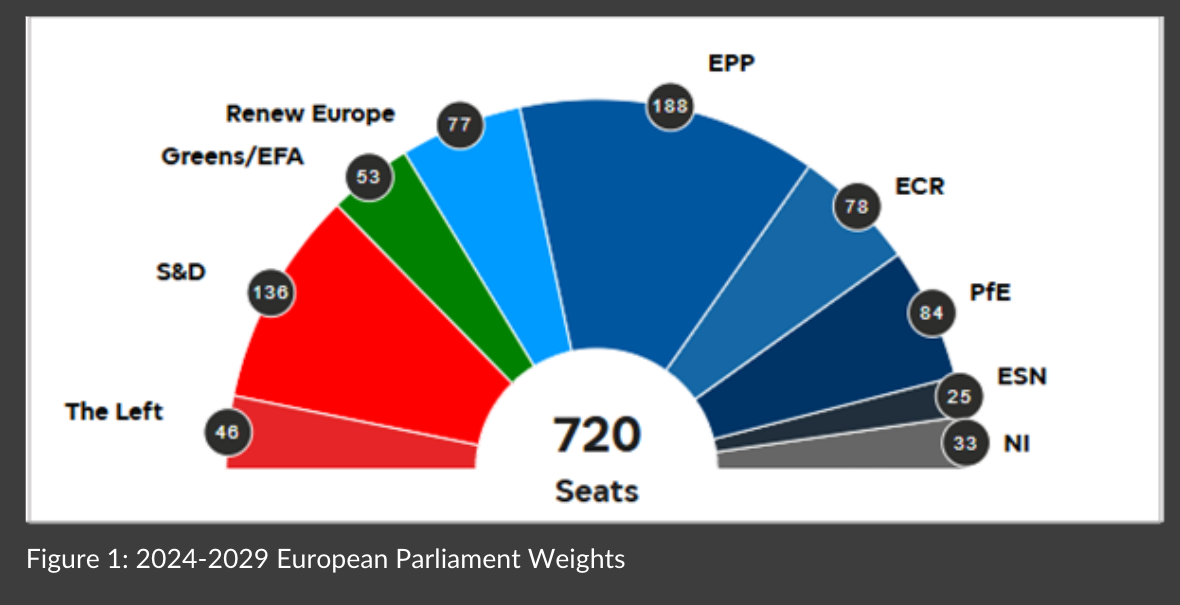

The European Parliament adopted a political spectrum towards the right and extreme right, with majority of MEPs now sitting on the right side of the hemicycle. The 2019 EU parliament elections were hailed as a “green wave”, with Greens making significant gains and paving the way for the European Green Deal. In contrast, this time round, the Greens have missed out on champions league, dropping points from fourth to sixth place. This reversal of fortune reflects a growing disenchantment among voters with the perceived costs and inconvenience associated with the green transition. The rise of populist and nationalist parties, now among the top contenders, has brough renewed scepticism towards the EU’s ambitious climate agenda. The political pressure to water down or delay measures is expected to intensify, as these parties push to appease their constituencies and address their concerns about the economic impact of environmental regulations. This political shift embodies movement from climate change and towards issues like immigration, economic woes, and struggling industries addressing industrial and economic competitiveness aspects of “sustainability”. With 28.22% of Prospers’ equity allocated within European markets, this political transformation raises concerns over expected volatility and regulatory changes amongst a fragmented ESG landscape. The fund must carefully navigate the shifting landscape and identify companies that remain committed to sustainable growth despite political headwinds.

European Competition

On the other side of the pond, the Trump administration filed an executive order to withdraw from the Paris Agreement and terminate the Green New Deal. Resulting in other countries demonstrating an unfairly burdened stance according to this inaction, resulting in the COP29 meeting in Azerbaijan missing the top leaders of the 13 largest carbon dioxide-polluting countries (PSB, 2024). Moreover, Trump’s additional deregulation actions have triggered a reversal in EU green initiatives, establishing a tit-for-tat like landscape according to pressures on Brussels to curve against the green agenda, calling for a temporary reform on “frivolous, excessive, and expansive regulation” according to “loosing competition every day” comparatively (The Financial Times, 2025).

The CSRD enters a sluggish phase, according to tensions between ambitious regulatory goals and practical realities within a new political landscape have reached boiling point - with Sophie Primas labelling “Today, the devil is in the detail” (Corporate Governance Institute, 2025).

This dynamic can be analysed through the lens of game theory according to businesses operating under stringent sustainability frameworks are playing the “cooperative game”, where the long-term goal established nash equilibrium at net-zero, social equality, and sustainable economic growth. According to Trumps decision to shift towards a “non-cooperative” game, the EU is pressures to move asymmetrically towards short-term economic objectives, delaying nash equilibrium and deteriorating the “common good” (Jean Tirole, 2016).

Von der Leyen, the European Commission president, acknowledged that “too many firms are holding back investment in Europe because of unnecessary red tape”, the commission is set to launch a “far-reaching simplification of sustainable finance and due diligence rules” to change the perception of US financiers who considered Europe to be “uninvestable” at the moment (The Financial Times, 2025). This originally sparked interest via the European Commissions publishment of a report on the future of European competitiveness, prepared by Mario Draghi, a former president of the European Central Bank, including detailed recommendations focused on there key themes: the need to encourage innovation, especially in advanced technologies; the opportunities created by the imperative to decarbonise; and a need to increase European security, including by reducing supply chain dependencies (Travers Smith, 2024). This report bolsters the case for the Commission’s existing commitment, part of long-term competitiveness plan, to reduce the burden of reporting requirements for companies by 25%, while Draghi argues an extension of the plan extending to SMEs targeting a 50% reduction, highlighting “each year European firms spend approximately €150bn on administrative costs (The Economist, 2025). The commissioner in charge, Valdis Dombrovskis, is not the chainsaw-wielding type, Europe needs to maintain its high environmental and social standards with at least three flagship laws expected to be watered down into one “omnibus” law, cutting reporting requirements for firms (simplification, not deregulation) (The Economist, 2025).

A simplification of regulatory reporting metrics may induce a short-term boost across energy, industrials, and manufacturing industries and Prospers’ portfolio returns. The greater issue stems from this divergence resulting in a lower sustainability-driven impact, introducing long term impact risk and increased greenwashing concerns across the five-year investment horizon.

The Trump Effect and European Alliance

Europe’s resistance to cut sustainable regulation and reporting is not the only factor affecting its competitive nature, a previously assumed alliance with the US continues to deteriorate amid Ukraine-Russia conflicts. The White House continues to freeze Europe, threating to leaved Europe for dead, unless terms are agreed on a $500bn Ukrainian minerals deal, while pushing Nato allies to shoulder more of the security burden, targeting at least 5% GDP to defence (BBC, 2025). Meloni’s tie with Trump - the only European leader to attend Trump’s inauguration – may not be enough soften the blows. The Italian prime minister has opted out of a G7 call marking the third anniversary of Russia’s invasion of Ukraine, she seems to be doing “high-wire acrobatics”, as she cannot turn back on Ukraine after consistently supporting Kyiv and Zelenskyy, however, on the other hand she must act carefully to avoid hints of criticism of Trump, affecting relations – she remains silent, hedging, and buying more time on which way to go - the ocean now seems too wide for a bridge between Washington and Brussels (The Financial Times, 2025). She remains “Italy First”; however, circumstances have swerved in a direction of extremity, signalling she may need to stay on good terms with her old friends closer to home according to Italy’s high debts and tepid economic prospects.

Trumps executive orders are expected to impose tariffs on Canada and Mexico (25%), with continued progression on China, alongside confirmed 25% on steel and aluminium globally and 10% on all Chinese imports in-effect (The Tax Foundation, 2025). Plans for European tariffs are only around the corner, as Trump continues to signal “pretty soon” actions to enforce a “price to pay” revolving around the EU-US trade deficit (BBC, 2025). Analysts expect a 10-20% tariff margin enforcement according to ODI Europe (The Economist, 2025), a think-tank, and 25% on European cars, according to Goldman Sachs (Reuters, 2025).

On the other hand, US-UK relationships seem to be greater according to the Bureau of Economic Analysis, estimating the US had a surplus on its trade with the UK in 2023 ($14.5bn) (BBC, 2025), alongside Trump complimenting Starmer, discussing their positive relationship. On trade with the UK, Trump said: “The UK is out of line. But I’m sure that one, I think that one, can be worked out”, presenting a more positive alliance than European tensions (BBC, 2025). Starmer is set to meet Trump on Thursday, however dealt a “tough hand”, as he confirmed to continue backing the Ukraine, while attempting to continue positive trade progressions with intent on negotiating the already enforced steel and aluminium tariffs (The Guardian, 2025).

Prosper Navigating Unknown Territory

Despite the political shifts threatening the ESG framework, Prosper must remain committed to sustainability as a long-term growth provider. The transition to a climate-conscious economy is still ongoing despite roadworks, Prosper will continue to position for related return while prioritising resilient ESG leaders, continuing diversification from the US, and updating it’s rigorous ESG screening process. According to Workiva, 85% of surveyed executives who intended to disclose emissions say they will move forward regardless of political developments, while 97% agree strong sustainability reporting will give businesses a competitive advantage in the next two years (Workiva, 2025). In particular, increasing UK ESG exposure could prove beneficial according to supposed Trump-Starmer relationship building, alongside the enforcement of implementing UK Sustainability Reporting Standards (SRS) - expected to be endorsed in Q1 2025 (Anthesis, 2025). Monitoring and increasing position within Nordic European countries offers a safer bet than other European nations, according to historic enforcement and support in sustainable regulation - Finland, Norway, and Sweden claiming top 3 spots in country sustainability rankings (Robeco, 2024). Outside of Europe, Australia (ALP) and New Zealand (NZLP), offer alternatives for diversification away from far-right political tensions and trump tariff headwinds. Australia are increasingly focused on strengthening their ESG frameworks, set to introduce mandatory climate disclosures under new regulation set in 2025, while New Zealand maintains its status as a sustainability frontrunner (Consultancy , 2025) (Herbert Smith Freehills, 2025).

Prosper must find the mid-point between valuation swings - amid trade wars and varied competition from regulation cost cutting - and maintaining impact retention through analysing company resilience despite the option to fall off regulation and reporting, to ensure success in the current climate.

References:

Anthesis, 2025. The Evolving Landscape of ESG Reporting Regulation. [Online]

Available at: https://www.anthesisgroup.com/insights/the-evolving-landscape-of-esg-reporting-regulation-expectations-for-2025/

[Accessed 14 01 2025].

BBC, 2025. EU tariffs ‘pretty soon’ but UK can be worked out - Trump. [Online]

Available at: https://www.bbc.co.uk/news/articles/cn4zgx808g7o

[Accessed 3 02 2025].

BBC, 2025. EU tariffs ‘pretty soon’ but UK can be worked out - Trump. [Online]

Available at: https://www.bbc.co.uk/news/articles/cn4zgx808g7o

[Accessed 23 02 2025].

BBC, 2025. How could trump’s tariffs affect the UK?. [Online]

Available at: https://www.bbc.co.uk/news/articles/ckgy1lerlpko

[Accessed 23 02 2025].

BBC, 2025. Trump is righ to engage Putin on peace talks, says minister. [Online]

Available at: https://www.bbc.co.uk/news/articles/ckgnrg77ydjo

[Accessed 23 02 2025].

Consultancy , 2025. Preparing for Australia’s new mandatory climate disclosure laws. [Online]

Available at: https://www.consultancy.com.au/news/10513/preparing-for-australias-new-mandatory-climate-disclosure-laws

[Accessed 24 02 2025].

Corporate Governance Institute, 2025. Anger over ESG reporting “hell” as the bloc signals changes to CSRD. [Online]

[Accessed 23 02 2025].

Herbert Smith Freehills, 2025. Keeping Up with ESG in Australia – 2025 outlook and recent updates. [Online]

[Accessed 24 02 2025].

Prosper Navigating Unknown Territory

Despite the political shifts threatening the ESG framework, Prosper must remain committed to sustainability as a long-term growth provider. The transition to a climate-conscious economy is still ongoing despite roadworks, Prosper will continue to position for related return while prioritising resilient ESG leaders, continuing diversification from the US, and updating it’s rigorous ESG screening process. According to Workiva, 85% of surveyed executives who intended to disclose emissions say they will move forward regardless of political developments, while 97% agree strong sustainability reporting will give businesses a competitive advantage in the next two years (Workiva, 2025). In particular, increasing UK ESG exposure could prove beneficial according to supposed Trump-Starmer relationship building, alongside the enforcement of implementing UK Sustainability Reporting Standards (SRS) - expected to be endorsed in Q1 2025 (Anthesis, 2025). Monitoring and increasing position within Nordic European countries offers a safer bet than other European nations, according to historic enforcement and support in sustainable regulation - Finland, Norway, and Sweden claiming top 3 spots in country sustainability rankings (Robeco, 2024). Outside of Europe, Australia (ALP) and New Zealand (NZLP), offer alternatives for diversification away from far-right political tensions and trump tariff headwinds. Australia are increasingly focused on strengthening their ESG frameworks, set to introduce mandatory climate disclosures under new regulation set in 2025, while New Zealand maintains its status as a sustainability frontrunner (Consultancy , 2025) (Herbert Smith Freehills, 2025).

Prosper must find the mid-point between valuation swings - amid trade wars and varied competition from regulation cost cutting - and maintaining impact retention through analysing company resilience despite the option to fall off regulation and reporting, to ensure success in the current climate.

References

Anthesis, 2025. The Evolving Landscape of ESG Reporting Regulation. [Online]

Available at: https://www.anthesisgroup.com/insights/the-evolving-landscape-of-esg-reporting-regulation-expectations-for-2025/

[Accessed 14 01 2025].

BBC, 2025. EU tariffs ‘pretty soon’ but UK can be worked out - Trump. [Online]

Available at: https://www.bbc.co.uk/news/articles/cn4zgx808g7o

[Accessed 3 02 2025].

BBC, 2025. EU tariffs ‘pretty soon’ but UK can be worked out - Trump. [Online]

Available at: https://www.bbc.co.uk/news/articles/cn4zgx808g7o

[Accessed 23 02 2025].

BBC, 2025. How could trump’s tariffs affect the UK?. [Online]

Available at: https://www.bbc.co.uk/news/articles/ckgy1lerlpko

[Accessed 23 02 2025].

BBC, 2025. Trump is righ to engage Putin on peace talks, says minister. [Online]

Available at: https://www.bbc.co.uk/news/articles/ckgnrg77ydjo

[Accessed 23 02 2025].

Consultancy , 2025. Preparing for Australia’s new mandatory climate disclosure laws. [Online]

Available at: https://www.consultancy.com.au/news/10513/preparing-for-australias-new-mandatory-climate-disclosure-laws

[Accessed 24 02 2025].

Corporate Governance Institute, 2025. Anger over ESG reporting “hell” as the bloc signals changes to CSRD. [Online]

[Accessed 23 02 2025].

Herbert Smith Freehills, 2025. Keeping Up with ESG in Australia – 2025 outlook and recent updates. [Online]

[Accessed 24 02 2025].

International Bar Assosciation, 2024. The year of elections: The rise of Europe’s far right. [Online]

Available at: https://www.ibanet.org/The-year-of-elections-The-rise-of-Europes-far-right

[Accessed 23 02 2025].

Jean Tirole, 2016. Economics for the Common Good. Princeton, New Jersey: Princeton University Press.

PSB, 2024. Leaders of the world’s biggest polluters are skipping UN climate talks. [Online]

Available at: https://www.pbs.org/newshour/world/leaders-of-the-worlds-biggest-polluters-are-skipping-un-climate-talks

[Accessed 23 02 2025].

Reuters, 2025. Trump reciprocal tariffs are key test of EU unity. [Online]

Available at: https://www.reuters.com/breakingviews/trump-reciprocal-tariffs-are-key-test-eu-unity-2025-02-19/

[Accessed 23 02 2025].

Robeco, 2024. Nordic nations sweep top spots in country sustainability ranking. [Online]

Available at: https://www.robeco.com/en-int/insights/2024/06/nordic-nations-sweep-top-spots-in-country-sustainability-ranking

[Accessed 01 03 2025].

The Economist, 2025. Europe is set to start cutting red tape-lightly. [Online]

Available at: https://www.economist.com/business/2025/02/20/europe-is-set-to-start-cutting-red-tape-lightly

[Accessed 23 02 2025].

The Economist, 2025. Europe races to confront America’s trade war. [Online]

Available at: https://www.economist.com/europe/2025/02/03/europe-races-to-confront-americas-trade-war

[Accessed 23 02 2025].

The Economist, 2025. Merz wins messy election then calls for independence from America. [Online]

Available at: https://www.economist.com/europe/2025/02/23/merz-wins-a-messy-election-then-calls-for-independence-from-america

[Accessed 23 02 2025].

The Economist, 2025. Who is ahead in the race for Germany’s next parliament?. [Online]

Available at: https://www.economist.com/interactive/2025-german-election-polls-prediction-forecast/forecast

[Accessed 23 02 2025].

The Financial Times, 2025. Brussels under pressure to curb green agenda in response to Trump. [Online]

Available at: https://www.ft.com/content/da348979-0261-4468-ba93-d6164fb1865b

[Accessed 23 02 2025].

The Financial Times, 2025. Italy’s Giorgia Meloni torn between supporting Ukraine and pleasing Donald Trump. [Online]

Available at: https://www.ft.com/content/8f0cc1ab-861f-4124-a9d3-af64c5b176d6

[Accessed 23 02 2025].

The Guardian, 2025. Starmer’s meeting with Trump will be PM’s biggest diplomatic test to date. [Online]

Available at: https://www.theguardian.com/politics/2025/feb/24/starmers-meeting-with-trump-will-be-pms-biggest-diplomatic-test-to-date

[Accessed 02 24 2025].

The Tax Foundation, 2025. Trump Tariffs: Tracking the Economic Impact of the Trump Trade War. [Online]

Available at: https://taxfoundation.org/research/all/federal/trump-tariffs-trade-war/

[Accessed 02 23 2025].

Travers Smith, 2024. Travers Smith’s Sustainability Insights: the impact of the Draghi report on ESG regulation. [Online]

[Accessed 23 02 2025].

Workiva, 2025. 2025 Executive Benchmark on Integrated Reporting. [Online]

Available at: https://www.workiva.com/resources/2025-executive-benchmark-integrated-reporting

[Accessed 09 03 2025].