Our investment philosophy is centred on the principle that value-based investing does not require investors to sacrifice a competitive return. We believe that finance has enormous potential to create positive social impact across all levels of society and socially responsible investment plays a pivotal role within that. By focusing on companies which are excelling in ESG, be they pioneering sustainable forms of energy production, developing new drugs to tackle disease or leading the way with regard to diversity, inclusion and employee care, we help to drive humanity forward into a better future.

How do we do it?

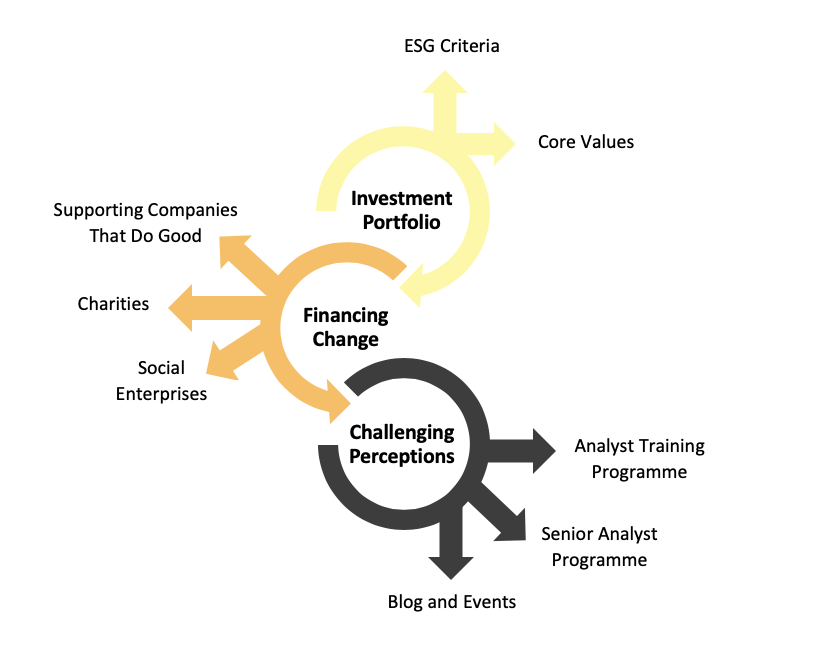

At Prosper we achieve social impact through our portfolio by applying initial and rigorous core-value/ESG assessments to any potential investment prior to any financial/macroeconomic analysis. For an investment to be added to the portfolio these assessments must be passed, with no exceptions. Investments within our portfolio are also regularly monitored to ensure that their core-value alignment and ESG-focus is maintained to our standard. In this way we have built and are continuing to build a portfolio of companies which are creating positive impact across a variety of industries and geographies.

Direct social impact

We further realise the importance of creating a local impact and so have worked to incorporate this into our investment strategy. Prosper operates on a 5-year investment horizon, at the end of which profits are redirected to social enterprises working in Edinburgh, Scotland, where we are based. In this way we further link our investment and social impact strategies.

We began by investing in European and North American public equities to reduce the complexity involved in procuring accurate data. At the present, this geographical restriction has been removed and we will look to invest in emerging markets to further diversify our portfolio.

Indirect social impact

To deliver an indirect social impact, our investment portfolio is deliberately structured by social challenges, rather than industries. Investment teams work within these sectors to find exciting investment opportunities.