History of Green Bonds

Green bonds, created in 2007, are fixed-income financial instruments designed exclusively for the funding of pre-specified environmental and/or climate projects, assets, and business activities. Green bonds function like regular bonds; they can be issued by governments, multinational banks or corporations, with the issuer repaying the premium and interest. Green bonds fund projects that contribute to achieving the Sustainable Development Goals: number 7 (affordable and non-contaminating energy) and number 13 (climate action).

The first green bond was issued by the World Bank in 2008, but the idea for financing environmental projects came from Swedish pension funds in 2007. The market for green bonds has become increasingly popular as attitudes towards sustainable investing have become more favourable. The cumulative issuance of green bonds since their inception in 2008 has reached more than $1 trillion, however, global green bond offerings constituted only 0.362% of total straight bond offerings over the period 2012-2021.

Purpose and Benefit of Green Bonds

Green bonds can be issued by public entities, private companies, and supra-national institutions. Since 2021, single countries such as the United States and China have been the largest green bonds issuers. There are a variety of motivations for issuing green bonds for companies; they offer a reputational advantage as they can be perceived as demonstrating a strong commitment to the environment and ESG goals, or they can provide an opportunity for innovation. Firms with a stronger innovative focus are more likely to issue green bonds to fund green technology improvements, as seen with Philips’ (Euronext: PHIA-NV) €750 million green bond offering in May 2019. Demand for green bonds has steadily increased as attitudes towards climate change have changed. A higher focus on combating climate change has resulted in a development in investors preference to green bonds. Firms substitute conventional bonds for green bonds to meet investor demand: green bonds saw a 49% growth rate in issuance from 2015-2020.

Certification and Standards

The Green Bond Principles (GBP) are international standards established by the International Capital Market Association (ICMA) that ‘provide guidelines for the issuance process, disclosure and reporting to ensure the integrity of the green bond market’. The standards have four core components: use of proceeds, process for project evaluation and selection, management of proceeds, and reporting. GBPs are voluntary best practice standards but are commonly used in the issuance of green bonds. Following ongoing criticisms of green bond regulations, the European Parliament has formally adopted the Green Bond Regulation as of October 2023 to standardise green bond regulations according to the use of proceeds, reporting and disclosure within the European Union.

Market Growth and Trends

There is a markedly distinct upward trend in new bond issues since 2014. The share of new green bond offerings within the overall bond market has reached a new peak of 5.5% in 2023. Public sector issuers maintain a significant presence in the market, accounting for one-third of all green bonds issued in the first quarter of 2023. Green bond issuance by corporate entities has increased rapidly, from 4.7% of total corporate bonds issued in 2020 to 8.3% in 2021 and 11.0% in 2022. On the demand side, there has been a 17% year-on-year surge in net assets in Q1 dedicated green bond funds.

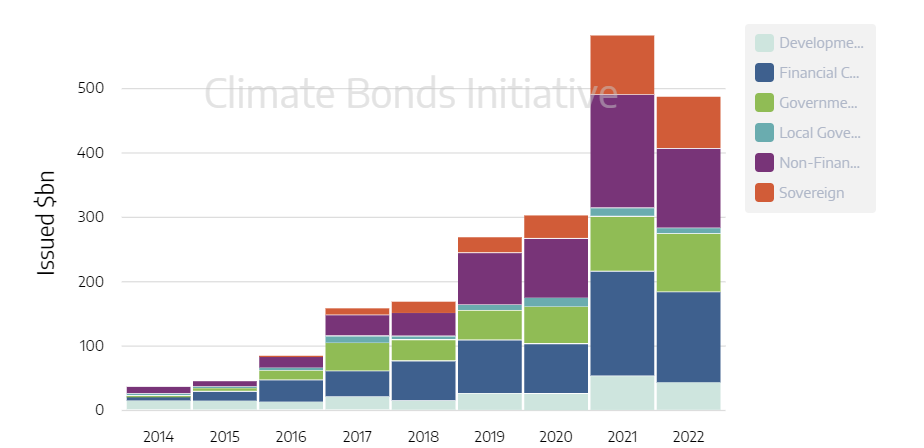

Issuer Type:

The most substantial share, comprising 29% of volumes, came from financial corporations, whereas non-financial corporations contributed 25%. Nearly half of private sector green issuance was attributed to European corporations. Government-backed entities accounted for slightly less than 20% of green issuance in 2022. They were the sole issuer type that experienced a growth compared to 2021, with a 6% increase. This rise was propelled by the European Union, which reopened its 2037 deal three times, totaling EUR 6.5 billion (USD 6.9 billion).

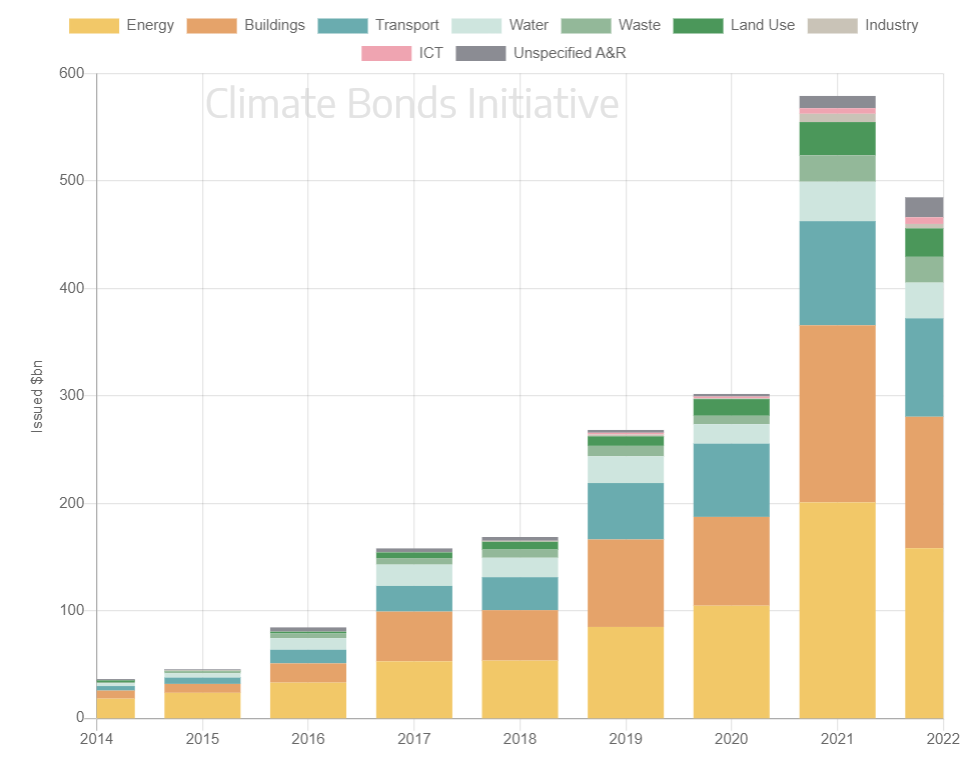

Use of Proceeds:

While the diversity in the use of proceeds from green bonds has maintained a consistent ratio, there has been a substantial increase in the volume of these proceeds, aligning with the rise in new issuances of green bonds. Energy, buildings, and transport are consistently the three largest use of proceeds categories, collectively contributing 77% of the total green debt volume. Nevertheless, this marks a decrease from the 81% reported in 2021 and the record-high 85% in 2020. Smaller categories are increasing their share as a growing number of issuers, including large sovereigns, are funding a more diverse array of projects.

Criticisms of Green Bonds

The primary criticism of green bonds is that they are exposed to greenwashing. Greenwashing is a term that ‘refers to the deceptive promotion of the perception that an organisation’s products, aims or policies are environmentally friendly’. The risk of issuers misleading investors about the environmental benefits of their projects is exacerbated because there is no single global standard or recognised legal definition for green bonds and their usage. Investors rely on issuers’ voluntary compliance to market standards and as such could be exposed to greenwashing. A lesser known criticism of green bonds is issuer fatigue. Due to the lack of single global standards and legal definitions an ever-evolving multiplicity of criterion, rules and disclosure reporting guidelines for issuer compliance has emerged with which they must comply. This includes (but is not limited to) stock exchanges, rating agencies, second party reviewers, disclosure reporting guidance, certifiers, index providers and industry bodies, each with their own criteria which must be followed. To ensure compliance with each is difficult and time consuming and risks include accidental non-compliance.

References:

https://www.climatebonds.net/market/data/

https://www.worldbank.org/en/news/feature/2021/12/08/what-you-need-to-know-about-ifc-s-green-bonds

https://www.ifc.org/content/dam/ifc/doclink/2022/the-green-bond-principles-202206.pdf

https://www.whitecase.com/insight-our-thinking/new-european-green-bond-standard-game-changer#:~:text=The%20European%20Green%20Bond%20Standard,applies%20to%20asset%2Dbacked%20securities.